Whether or not you own your own private practice (yet), you would of – more than likely – come across the terms ‘W-2’ and ‘1099’. You may or may not know what they mean, or what their significance is with regards to private practice. The intent behind this blog post is to clarify any and all confusion associated with these terms, the importance of them, and the difference between the two.

The Definitions

Let’s start by looking at the definitions of both an independent contractor and an employee:

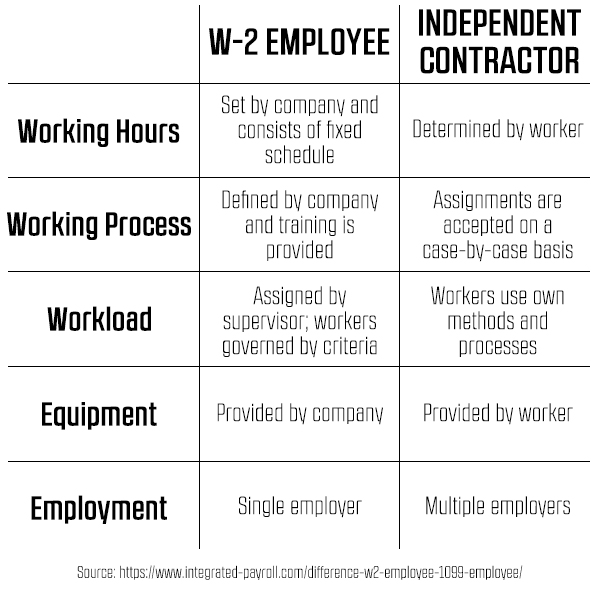

An independent contractor can be defined as a freelancer or someone who works for themselves. As such, should you choose to ‘employ’ an independent contractor, you would do so through a contract. This contract would specify both the period of employment as well as the project requirements. Within this contract, the independent contractor may determine their own working hours. And, they will make use of their own resources in order to complete their task/s. They are also free to complete projects for other companies while they are working for you. Due to their freelancer status, you will not be required to withhold taxes from their salaries, or provide any benefits. They will be responsible for their own taxes.

In contrast to this, an employee is recruited by you under a particular employment contract. Within this agreement, you are responsible for withholding taxes from their salaries (and then paying them), withholding and paying Social Security and Medicare taxes, and paying unemployment tax on their salaries. You will also be required to provide the necessary training needed for the employee to perform and may or may not include benefits as well. Due to the nature of this set up, you have more control over the employee and will be able to decide on their working hours as well as what they spend their time working on.

So, Who Is An Independent Contractor?

As can be noted from the two definitions above, the main difference between an independent contractor and an employee is the amount o control you have over their working hours and work requirements. In ‘official’ terms, the IRS reviews the following three factors in order to determine whether someone working for you is an employee or an independent contractor:

- Behavioural: Are you in control of the worker’s hours and job description?

- Financial: Are you in control of the administrative and resource-based elements? For example, reimbursement of expenses / provision of necessary resources.

- Type of Relationship: Do you have a written contract in place? Do you provide benefits? Is the job permanent? Is the worker performing a fundamental role in the business?

Another way to determine whether or not a worker is an independent contractor or an employee is to review the following:

If, at this point, you are wondering why we are going so in-depth into the difference between an independent contractor and an employee, it’s because this information is vital to your business. Misclassification of your employees can result in unexpected financial penalties. These include:

- Reimbursement for wages you should have paid an employee, like overtime and minimum wage

- Back taxes and penalties for federal and state income taxes, Social Security, Medicare, and unemployment

- Payment for misclassified employees’ workers’ compensation benefits

- Providing employee benefits, including health insurance, retirement, etc.

(Source: https://squareup.com/townsquare/1099-vs-w2-which-do-you-want)

W-2 Versus 1099

So, getting back to our original question about the difference between a W-2 versus a 1099… If you haven’t picked up on this yet, these are actually the tax forms required for the varying types of employment. For example, a 1099-MISC is used to outline payments made to an independent contractor, while a W-2 form is used for employees. Find a few pointers on each below:

Basics of W-2 Form:

- Business details annual payment made to employee as well as payroll taxes withheld from these payments

- More detailed than 1099 due to details regarding deductions, including: federal, state, and local income taxes, Social Security tax, Medicare tax, and any employee-paid amounts for insurance and retirement

- Employees receive W-2 from from employees by January 31

- W-2 form can be obtained from IRS website

- W-2 form is submitted to the IRS and Social Security Administration

Basics of 1099 Form:

- Sequence of documentation put together by companies in order to detail payments made to an independent contractor

- ‘Employer’ who pays over $600 to an independent contractor in one year is required to send a completed 1099-MISC (Copy B) to the contractor by January 31

- The employer is also required to submit this 1099-MISC (Copy A) to the IRS by January 31

- If you’ve submitted multiple 1099-MISCs to the IRS physically, you will need to fill out a Form 1096 to outline all of the 1099s you have submitted (this, however, does not have to be done if you have submitted your 1099s electronically)

- 1099 form can be obtained from IRS website

- 1099 form is submitted to the IRS

Testimonials From Private Practice Owners

“My preference comes out of two things – one is not wanting to get involved in payroll and workers comp issues and two is many folks not wanting to be employees – maybe it feels too rigid?” – Amy Fortney Parks

“For me 1099’s require less overhead and less oversight on my part. But you do need to be more thorough on the front end with your hiring. Need to make sure it is the right fit and you get someone who is very self-motivated. I am however going to look into getting W2 people this next year since it will possibly allow me to get group health insurance for people in the practice.” – Gordon Brewer

“I have eight 1099s. I realized that I love fostering a sense of independence in others and watching people have those conversations with themselves about money or developing their niche. I want the people I work with to be leaders and not technicians. At the end of the day, all our clinical work comes to an end, but the real growth comes when we create a deeper understanding of why we do what we do.” – Ruth Exley

Samantha Carvalho is the Chief Marketing Officer of Practice of the Practice. She lives in Cape Town, South Africa, with her husband and kitten. Over and above Practice of the Practice, she is passionate about women empowerment, fashion, and animals.

Samantha Carvalho is the Chief Marketing Officer of Practice of the Practice. She lives in Cape Town, South Africa, with her husband and kitten. Over and above Practice of the Practice, she is passionate about women empowerment, fashion, and animals.

Click here to outsource your marketing or contact Sam at [email protected].